Rami Tabbara, 40, co-founder and co-CEO speaks to me on Zoom from Stake’s “cool set-up” at the Dubai International Financial Centre (DIFC) located on Gate Avenue’s shiny financial and fintech district. He scans the camera around the office, to where his team are busying away behind the scenes in their open-plan, glass-walled office space before settling back at his desk. Over his shoulder, a whiteboard is scribed with complex, hand-drawn flow charts and equations, which he says are the workings of his product team, masterminding the user journey behind his company’s app.

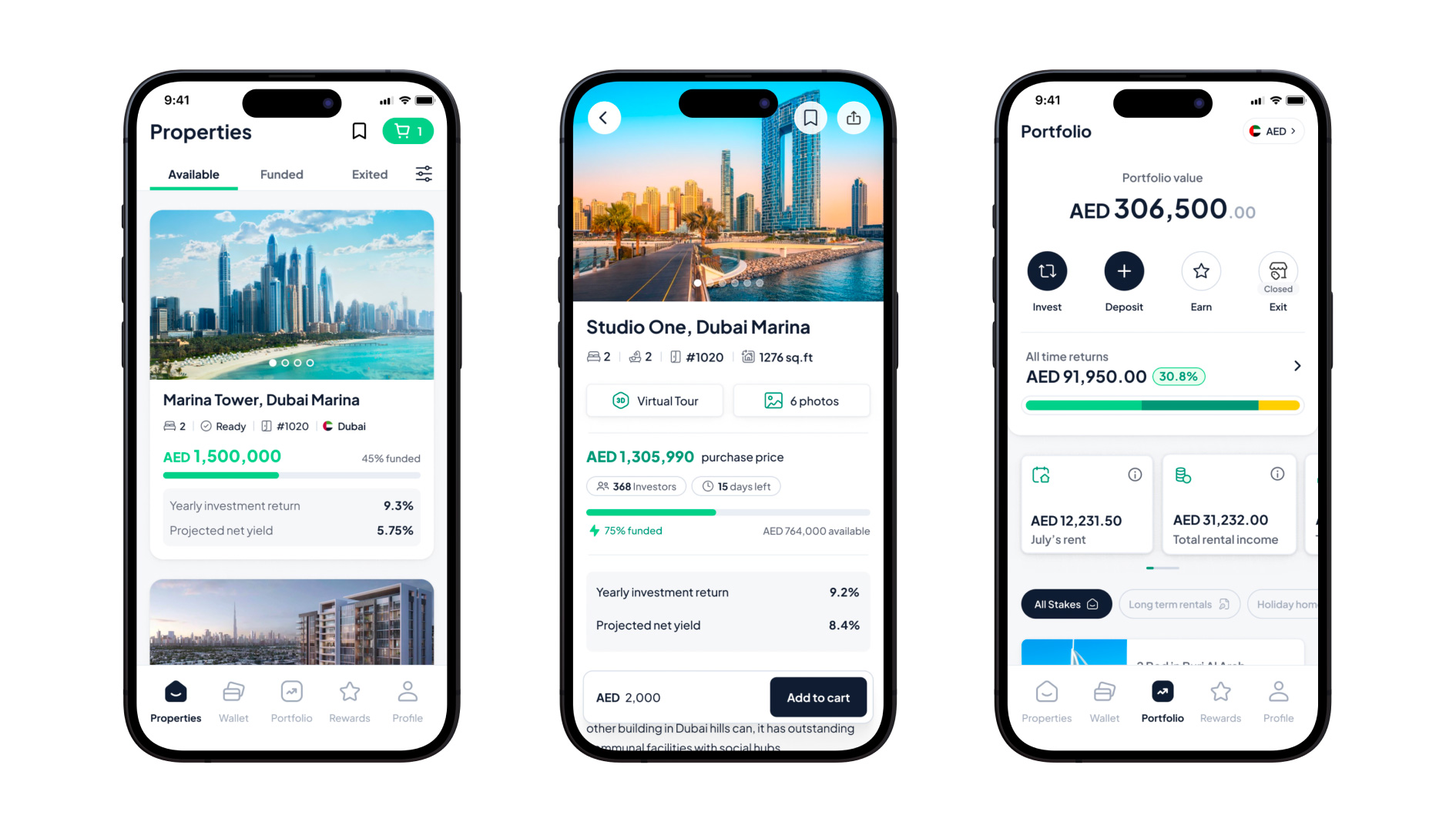

“I say this with confidence: we’ve built the most advanced real estate platform in the world,” says Tabbara proudly. “It allows anyone to own a piece of Dubai real estate in under three minutes – just like shopping on Amazon or ordering food on Deliveroo.”

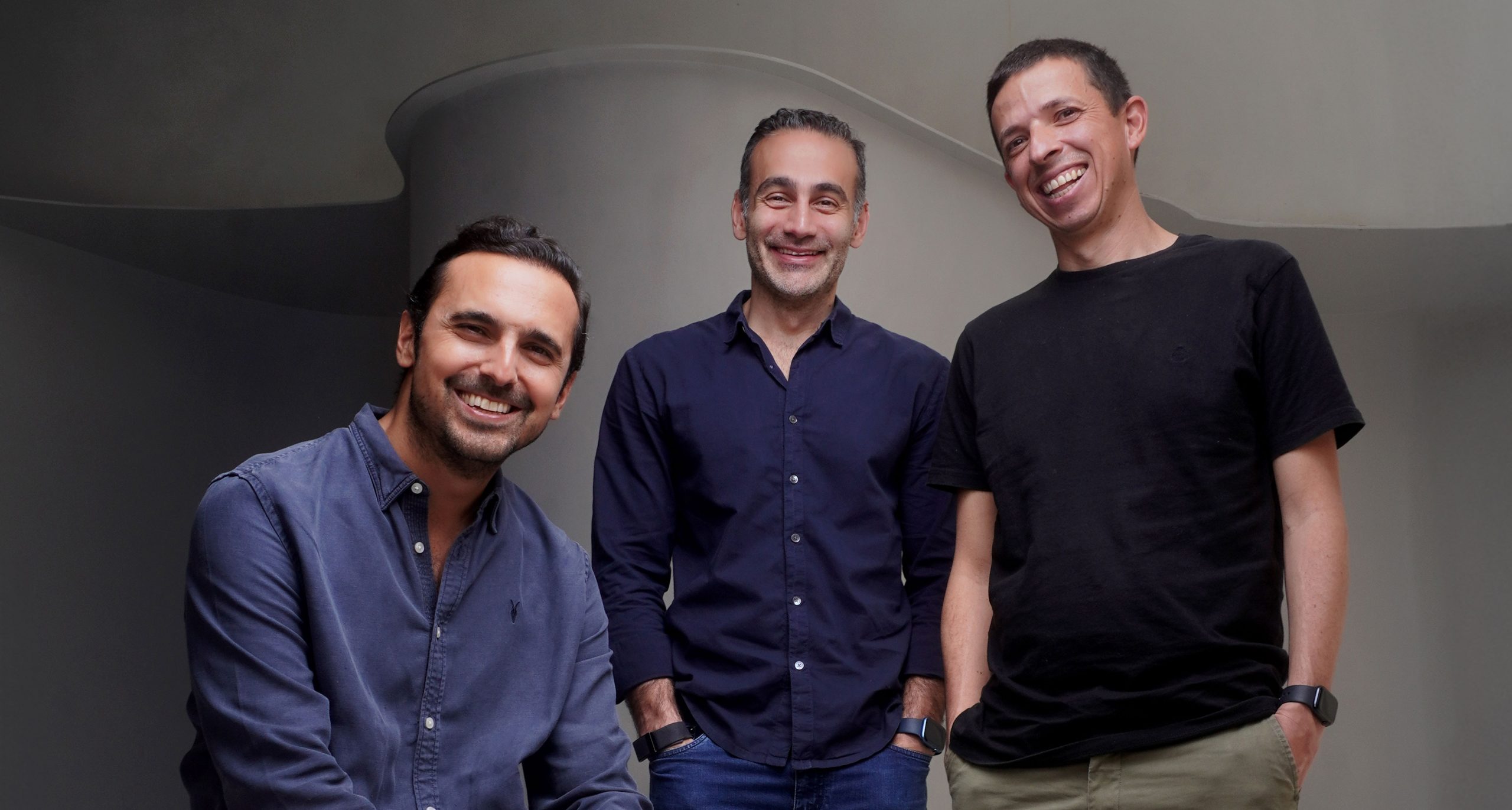

ABOVE: Stake’s founders Rami Tabbara, along with Manar Mahmassani and Ricardo Brizido take pride in the fact they have an international base of over 800,000 users from 206 nationalities and 175 countries to which they have paid over 4.5 million USD worth of rental income so far. That equates to roughly 4 to 7 per cent per year.

It works like this. Stake is a digital real estate investment platform with around 800,000 users. By downloading and signing up to the app, anyone, anywhere in the world can invest in Dubai’s top prime residential properties and join the 206 nationalities from over 175 countries currently invested in Stake. It’s regulated by the Dubai Financial Services Authority. Users upload proof of address and their passports for the relevant KYC checks. It is this fluidity and accessibility which is the app’s selling point. And you only have to part with 135 USD (500 AED) via a simple click on Apple Pay or bank transfer to start a property portfolio. Entry-level investors include a taxi driver from Mauritius, Emirates air stewards and UAE waiting staff, who now boast shares in Dubai’s lucrative bricks and mortar. This breadth of user base is right at the heart of Stake.

Tabbara and his team have even put residences in the Burj Khalifa on their map. “It was amazing because people from all over the world owned a part of the Burj. Sometimes we do iconic buildings if the returns make sense,” he says.

Taking the first rung on the property ladder is becoming a major anxiety for Gen Z, who are priced out by rising real estate prices. Tabbara says the app gives its users a feeling of ownership. “Culturally, we are taught by our parents to put money into real estate. Now, we can experience how it feels to own a property that we may one day own ourselves. It is a long-term investment which leads to generational wealth. I was fortunate enough to afford my own property when I was 23 and I realised how important it was.”

At the other end of the scale, Stake attracts the big-ticket investors. “One investor has put over 7 billion dirhams on the platform – that’s 2 million dollars,” Tabbara explains. A deal with the Dubai government permitting Stake to offer golden visas, which allow a ten-year residency, is an obvious incentive. “To get a golden visa you need to invest 2 million dirhams (545,000 USD) into a property in Dubai. So, we asked the government to allow us to issue golden visas to those who bring 2 million dirhams to our platform. Rather than putting it into one property, they can invest it across, say, 20 properties, and it’s hassle-free, digital and well diversified. Investors receive a tangible every month – a second income as they do when they are paid their salaries, straight into their Stake wallets. And they can withdraw that rental income into their bank accounts with the press of a button.”

Investors get a portfolio including 3D tours, photos and valuation reports. “They buy into something that exists. We only have properties that are tenanted or vacant but ready to be rented so we don’t take on any risks. Once a property is 100 per cent funded, the investor will start getting a rental income within a maximum of two to three weeks.”

Tabbara is clear that Stake is well-regulated and discerning with its property listings. “We are a curated marketplace. We only select properties that make sense from an investment point of view. They need to be the right price, in the right location, with the right view. The developer of the building needs to be of a good standing. We’ve built a data model that allows us to run all of this in minutes. We can literally put an offer on the building in 24 hours which is faster than the market.”

Then there’s the paperwork. Every property is registered under a special purpose vehicle (SPV) company, so that all investors receive shares in the company that owns that property. “They get two sets of legal documents that show their ownership: share certificates because those SPVs are registered with the DIFC and title deeds from the Dubai land department in the name of that SPV. For example, we put over 1,600 investors into one property and we digitised the entire journey,” Tabbara explains.

Despite falling into real estate by mistake, it is clear that it is a labour of love for Tabbara. It’s not unheard of for him to take customer calls at 4am. “In this part of the world, there’s a huge affinity with real estate – the doctor, the dentist and the barber all talk about it. It’s a seven-days-a-week, 24-hours-a-day job. You have to have a passion for this.”

ABOVE: In May 2024, Stake surpassed 100,000 transactions on the platform, accumulating 200 properties in just three years of business (worth 100 million USD). It is regulated by the Dubai Financial Services Authority (DFSA), and now the Capital Markets Authority (CMA) of Saudi Arabia too.

Back in 2006, aged 22 and a fresh graduate from the American University of Beirut, Tabbara moved to Dubai (where he has resided ever since) to take a role at an FMCG company. “I did it for two weeks and hated my life,” he confesses. But he was in the right place at the right time. A contact was launching The First Group property development company out of a two-bedroom apartment and offered Tabbara a role as a sales VP in his first start-up. “I stayed with them for 12 years as the real estate market was on fire. Dubai was going through unprecedented change; everyone wanted a piece of Dubai real estate, and I was at the forefront of that.”

“The population growth in Dubai is phenomenal, it’s attracting capital from all over. Many millionaires from around the world are moving to Dubai. Some of the rental yields are the highest in the world. I was with somebody yesterday who is making 0.5 per cent return on his property in London. In Dubai, you can make five to six per cent net. It presents opportunities that can’t be matched by some of the main capitals around the world.”

After a three-year stint as a senior vice president of sales at DAMAC, Tabbara started to branch out independently. He joined forces with Stake’s co-founders – his high school friend of over 25 years Manar Mahmassani and Ricardo Brizido. The app went live in January 2021.

Stake was on the drawing board through the pandemic, which Tabbara admits was a “blessing in disguise” for a digital start-up. “Everyone thought I was crazy doing this during Covid. But I remember coming home one day and saw my 75-year-old grandmother in Dubai ordering groceries on an app, and I saw how the world was changing. People spent so much time indoors, they realised how important real estate is. How important the home is.”

And now, there’s the current unrest in the Middle East to contend with. Just days before our interview, Rami Tabbara was organising flights to evacuate close relatives from Lebanon. He says Dubai shields itself from uncertainty. “There’s always a risk that markets will fluctuate. But, if we go back and study the real estate market during all the conflicts that have happened, from the Iraq War to the Kuwait War – even the Arab uprising – they have benefitted Dubai’s market. Dubai is seen as a beacon of stability in the region.”

Stake just launched in Saudi Arabia too at the end of October 2024. “We really believe that over the next 10 years, Dubai and Riyadh will provide solid real estate and an economic background that allows steady growth and yields higher than anywhere else in the world. It’s a golden age for Saudi and the UAE from an infrastructure perspective.”

Tabbara has also received interest from sources in Hong Kong and Singapore and has just returned from meetings in Miami. “In the next 12 to 24 months we want to double down in the UAE and Saudi, but that’s not to say we won’t be looking at other markets. Nobody has yet created a single app where you can invest in a piece of a property in London, New York and Dubai, and we feel we can do that. Our user base is so international that they will want to diversify their portfolios. We will look at those markets very soon, but focus is key for us.”

PHOTOGRAPHY: BOULA ABDELNOUR